Two otherwise similar programs might have two different payment schedules. One might do a payment upfront. Another might do a significantly larger payment 20 years from now. Which one is better?

NCX adjusts for payment timing to help you do an “apples-to-apples” comparison between different payment schedules. The basic idea is that receiving a payment of $100 today is better than getting that same payment sometime in the future. And getting the $100 in a year is better than getting it in 40 years!

NCX uses a standard financial approach called “net present value” to enable an “apples-to-apples” comparison between different payment schedules. If you’d like to learn more about how net present value (NPV) works, this 10 minute video is a great introduction.

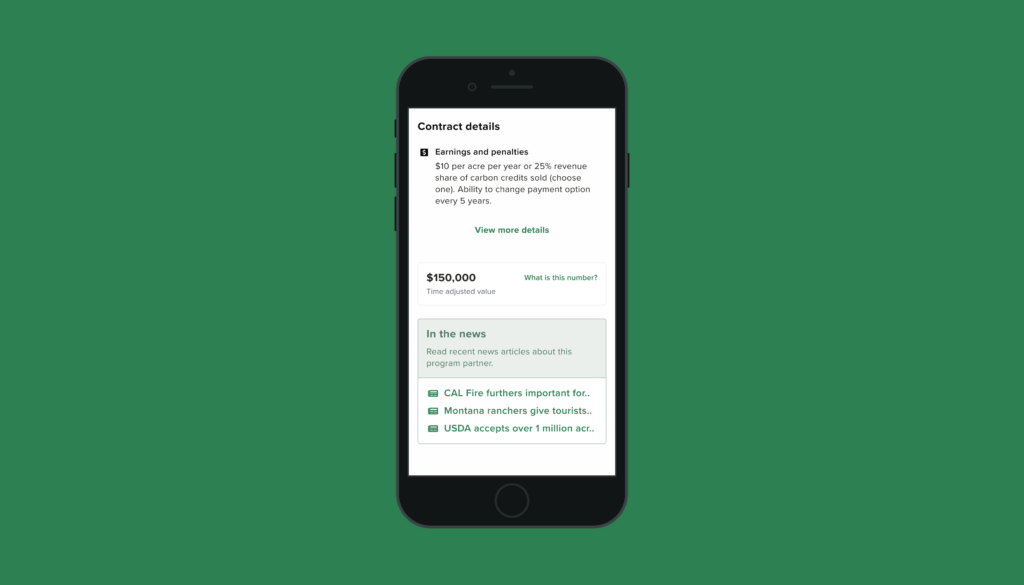

You can find the estimated net present value on the right side of each program’s page on NCX.com. Please note that these estimates are for illustrative purposes only and there are many details that may alter the payments you receive for any given program. Not all programs may have an NPV estimate yet.

We can see by considering two different forest carbon programs that both require the landowner to not harvest their trees for 20 years.

Example 1: Upfront Payment

The first program offers an upfront payment of $50,000. Because you get that money today, this as an easy one! There is no delay in payment, so there is no deduction. The net present value of a $50,000 payment today is $50,000.

Example 2: Bigger Payment in 20 years

The second program offers a bigger payment of $100,000, but it pays out at the end of the 20 year term. While this might seem like it’s twice as good as the first program (which only offered $50,000), it turns out that the NPV of $100,000 paid out 20 years from today is actually only $45,638.

So even though the nominal dollar amount is higher in this second program, the first program is a better deal! Payment timing really matters. This is why it’s so important to account for different payment schedules when choosing the right program for you and your land.

Ready to see the estimated NPV of each program on your property? Create a free account on NCX.com to discover the true value of your land.

Technical note: These NPV calculations use a discount rate of 4%, based on 30 year treasury bond yields from January 2024. Your personal discount rate might differ. Of course, it’s also important to adjust for inflation and other factors.

Disclaimer: The content of this post is for informational purposes only and is not intended to be investment or financial advice.