Introduction

Your land is a portfolio of natural capital. Just as your financial portfolio might consist of your home, stocks, bonds, and other financial assets, your Natural Capital Portfolio consists of timber, water, carbon, wildlife habitat, soil, and other Natural Capital Assets.

In this article, we’ll explore how you can grow and monetize your Natural Capital Portfolio.

Growing Natural Capital

There are many ways to invest in your Natural Capital Portfolio and grow the value of particular Natural Capital Assets over time. For example, planting trees will gradually increase both the amount of carbon and the volume of timber on your land.

Growing natural capital often requires an investment of money, labor, and time. However, you can often multiply your investment by taking advantage of government cost-share programs. The government may cover 75-90% of the cost of implementing practices that improve certain types of Natural Capital Assets. If you are planning to create nesting bird habitat, destroy invasives, plant hardwoods, or promote pollinator habitat, government cost-share programs might be a great fit.

Also note that there are often tradeoffs between different Natural Capital Assets on your property. You might choose to improve deer habitat by clearing some trees to create a food plot. This would increase the quality of deer habitat on your land but decrease the amount of timber and carbon.

Your natural capital portfolio is also subject to important risks. Threats can come in the form of extreme weather, pests and pathogens, invasives, and economic shifts. For example, a southern pine beetle infestation or wildfire could zero out your timber and carbon assets in a single season. To protect long-term investments in your natural capital portfolio, you should proactively identify and mitigate key risks.

Monetizing Natural Capital

You are probably already familiar with some ways of turning Natural Capital Assets into cash. For example, timber sales are a traditional way to convert standing timber into dollars. Generally speaking, the bigger and higher quality the trees, the more money you’ll make.

Many landowners are also familiar with hunting leases as a way to monetize the game species habitat on their property. The better the habitat on your land, the higher the rates you can charge.

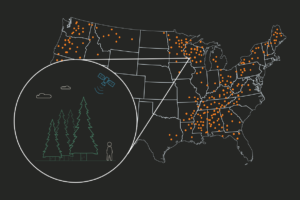

Emerging markets for Natural Capital Assets like carbon, water, and wildlife habitat are creating new monetization opportunities for landowners and increasing the value of your Natural Capital Portfolio. For example, many landowners now have access to forest carbon programs. In exchange for agreeing to maintain the amount of carbon on your property for a certain period of time, you can receive annual payments from a carbon project developer. The developer in turn sells the “carbon credits” created by your land.

Many of these emerging natural capital programs have a similar lease-like structure that will be very familiar to any landowners who have engaged with hunting or timber leases. However, each market has its own nuances and it’s important to understand all the risks, rewards, and restrictions before you engage in any natural capital transactions.

Explore your options

Just like you have many investment options for your financial portfolio, landowners today have many options for growing and monetizing their Natural Capital Portfolio. New programs are emerging, prices are constantly changing, and threats like wildfire or pine beetle can decimate the value of your portfolio.

NCX, the Natural Capital Exchange, helps you manage your Natural Capital Portfolio with confidence. Learn about the various natural capital programs your land is eligible for and get alerts about potential threats. NCX’s team of experts is here to help you find programs aligned with your goals so that you can confidently invest in the future of your family’s land.