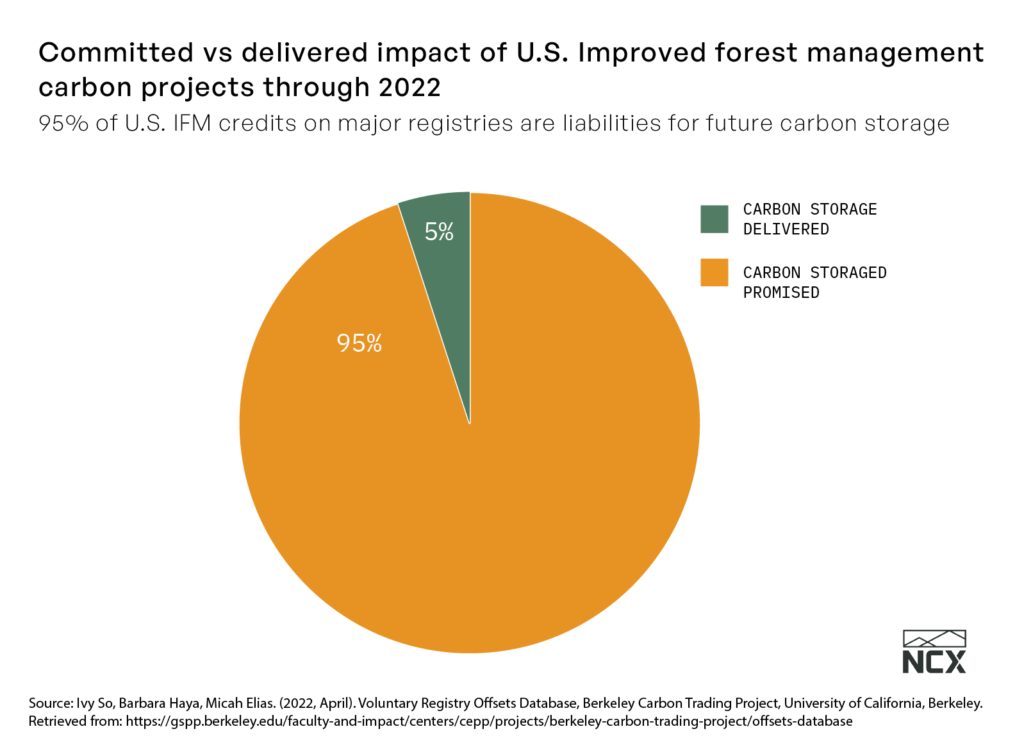

Carbon credits incentivize action that benefits the climate. How and when we credit that benefit matters. As of today, nearly 95% of the promised carbon storage from traditional forest carbon projects has yet to occur. Still, many of them have already issued credits for the promise of future results. Should we credit promises or realized results?

The elephant in the room is the risk that many of these promises ultimately don’t get fulfilled due to the underlying forest falling to intensifying wildfire, pest infestations, or strong storms. In these cases, a buyer will have paid but the climate will have never received the intended benefit. This is a risk not only to the climate, but also to that company’s ability to make reputable public claims about what they’ve done to help the climate. Who wants to end up on the front page of Bloomberg or The Wall Street Journal being accused of greenwashing when a wildfire wipes out the forests that were central to a company’s prior public proclamations of climate impact?

To reduce risk for the climate and for buyers, the carbon credit industry needs to move more decisively to only issuing credits for projects after the incentivized climate benefit has occurred and been measured. This better approach is called ex-post crediting. By contrast, standards bodies and project developers should deprioritize the issuance of carbon credits that depend on risky future promises. This riskier approach is called ex-ante crediting.

Unfortunately, not all carbon standards use these terms the same way in their publicly-available materials. That decision has profound implications for how much confidence customers can have in the promised climate benefits of the carbon credits they purchase. For clarity amidst this confusion, buyers considering purchasing carbon credits should ask, “when I take delivery, will this credit represent a realized benefit to the climate, or am I being asked to take a risky bet based on promises?” Only the former guarantees quality.

Interested in learning more about raising the bar in forest carbon? Sign up for our newsletter to ensure you receive the next piece in our series on minimizing risk.